How Personal Guarantees Impact Your Credit Limits, Rates, and Funding Options

Dec 11, 2025

Most entrepreneurs hear that they should avoid personal guarantees at all costs. The idea sounds appealing because it promises protection and separation between personal and business credit. The problem is that the conversation online rarely explains what a personal guarantee actually is or how it affects your ability to get approved, secure higher limits, or unlock better rates.

Before you decide whether to pursue PG or non-PG funding, it helps to understand what a personal guarantee really involves and why lenders rely on it in the first place.

This brings us to the first question you need to answer.

What Does “PG” Mean in Business Credit?

A personal guarantee is a commitment that you will repay a business debt if the company fails to do so. It does not merge your personal and business credit. It simply gives the lender a secondary layer of protection. Banks use PGs because most small businesses lack a long credit history, and the PG helps them measure risk more accurately.

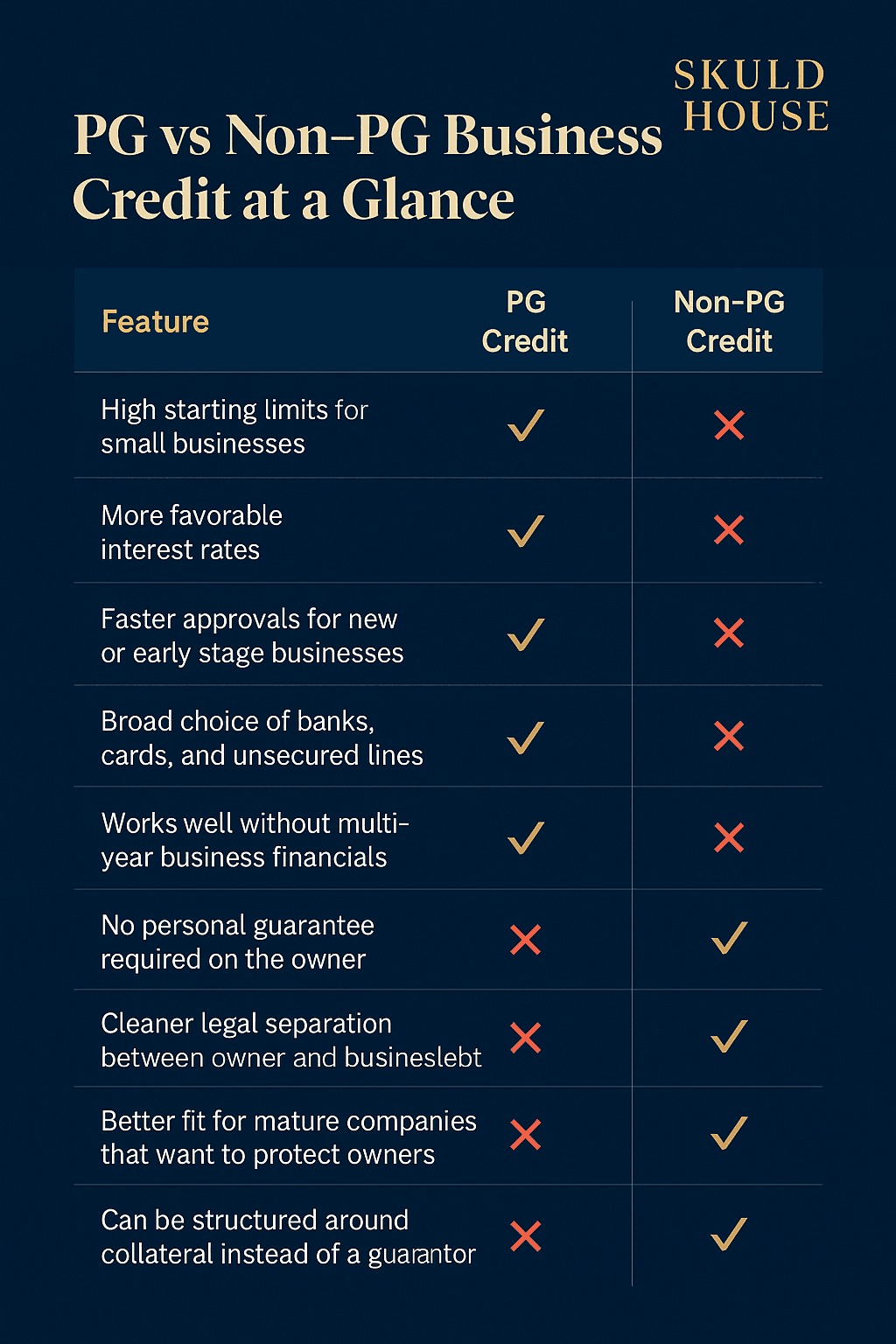

Most PG accounts do not appear as a tradeline on your personal reports* unless the account defaults or becomes severely delinquent. For most borrowers who pay on time, it never touches their personal credit profile. In practical terms, this gives you access to higher limits, lower rates, and a wider range of products. It also speeds up approvals because the bank has more confidence in the overall credit picture.

This is why the PG conversation online often misses the mark. Let’s now explore why so many founders try to avoid personal guarantees in the first place.

*Some business credit vendors do report all tradelines to your personal credit profile. For example: Capital One. At Skuld House, we recommend caution when considering such accounts.

Why So Many Entrepreneurs Chase Non-PG Credit

Many founders look for non-PG credit because they want clean separation between their personal finances and the business. They worry that signing a personal guarantee exposes them to unnecessary risk or ties their personal credit to the company’s performance. That concern is understandable, especially for new business owners who are still building confidence in their operations.

A second factor is misinformation. Social media often frames non-PG credit as the ultimate marker of a “real business,” or as a way to build business credit without putting anything on the line. These claims create the expectation that avoiding a PG is both safer and more legitimate, even though most lenders do not view it that way.

The Federal Reserve’s Small Business Credit Survey shows that approval rates increase significantly when owners provide guarantees or collateral. Younger businesses in particular see higher rejection rates when applying without these forms of support.

There is also a fear-based element. Entrepreneurs worry about worst-case scenarios and assume that a PG means automatic personal liability. They are not aware that PG-backed accounts do not report to personal credit unless the business defaults, which means the practical risk is far lower than the fear suggests.

These motivations are common, but they rarely reflect how lenders actually underwrite business credit. That gap between perception and reality creates the problems that show up in the next section.

The Hidden Risks of Non-PG Credit Accounts

Non-PG credit sounds appealing because it promises distance from personal liability. In practice, it often limits the business more than it protects it. Lenders take on greater uncertainty when they cannot evaluate the person behind the company, and they compensate for that uncertainty through stricter terms.

The first problem is lower credit limits. Non-PG products typically start small and stay small until the business shows years of consistent revenue and strong internal credit history. This restricts cash flow and slows down growth for younger companies.

The second issue is pricing. Higher lender risk often leads to higher interest rates, tighter repayment schedules, or fees that would not appear on comparable PG-backed products. These costs compound over time.

Access is limited as well. Many major banks reserve true non-PG lines for companies with substantial revenue or long-standing treasury relationships. The options that remain tend to be narrow tools such as fleet cards or vendor-specific accounts. Vendor and fuel cards help with operational spending, but they rarely improve a company’s ability to access larger unsecured credit.

Underwriting requirements add another layer of friction. Without a guarantor, lenders rely heavily on business tax returns, bank statements, cash flow, and collateral or deposit-backed structures. These hurdles screen out most new or growing companies.

Industry data and bank disclosures consistently show that non-PG credit comes with lower limits and stricter terms because lenders carry more risk when they cannot evaluate the owner’s credit profile.

When Non-PG Business Credit Makes Sense

There are situations where non-PG credit is a practical and strategic fit. Mature companies with strong revenues, established financial systems, and multiple stakeholders sometimes prefer to limit personal exposure for owners or executives. These businesses already have the internal stability and documentation that non-PG underwriting requires.

Major banks like Chase, Wells Fargo, and Bank of America reserve non-PG lines for established commercial clients with multi-year revenue history, positive cash flow, and active relationships. This reflects the higher risk profile of unsecured credit without a guarantor.

Non-PG credit can also be useful for specialized needs. Fleet cards, fuel programs, and certain vendor accounts often operate without a personal guarantee. For companies with predictable spending in those categories, the structure is convenient and low friction.

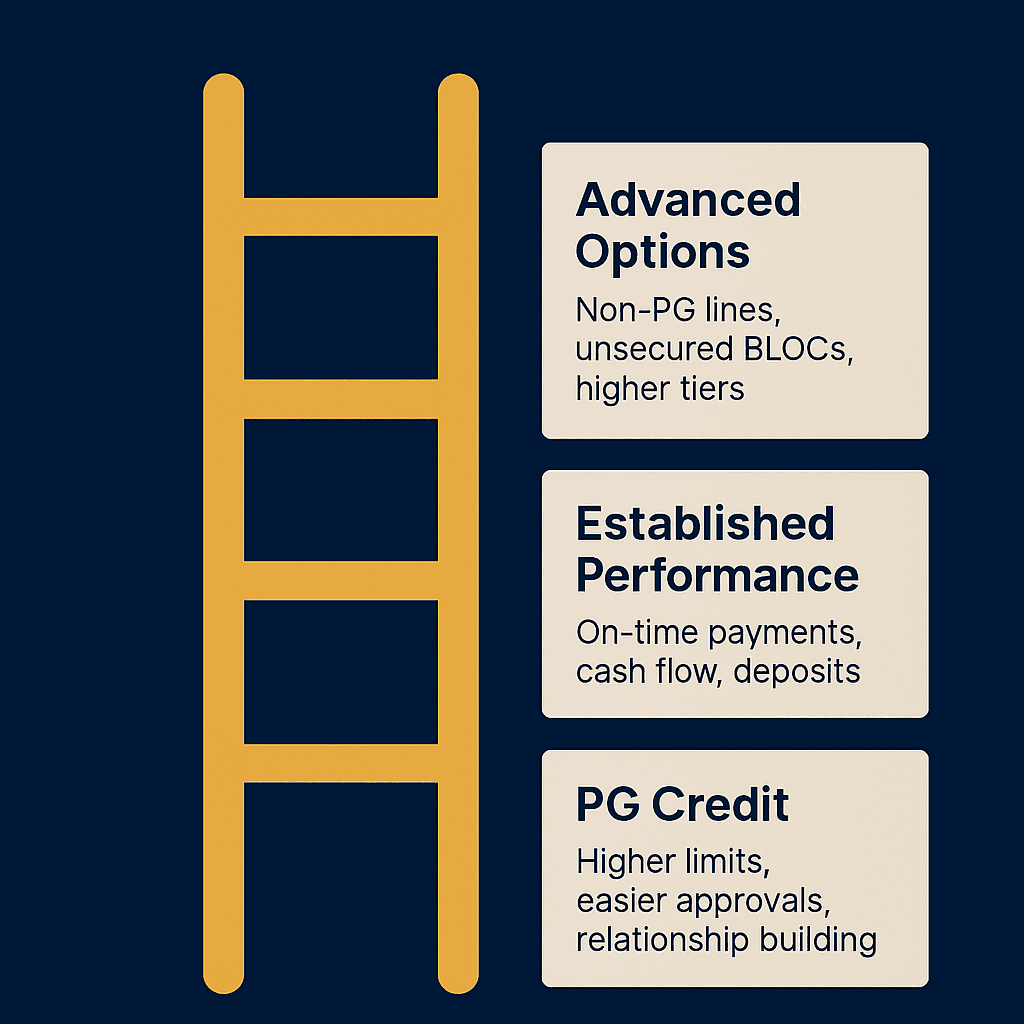

Another valid case is progression. Businesses that already built trust with lenders through PG-backed accounts sometimes gain access to non-PG options over time. At that stage, the company’s performance, not the owner’s personal credit, becomes the primary underwriting factor.

These situations are the exception rather than the norm, but they show that non-PG credit is not inherently bad. It simply requires a level of business maturity or specificity that many early stage companies do not yet have.

Why Using a Personal Guarantee First Unlocks Better Funding

A personal guarantee strengthens your funding profile because it reduces uncertainty for the lender. When a bank can evaluate both the business and the owner, it has a more complete picture of risk. That confidence shows up in higher limits, lower interest rates, and faster approvals. For most early stage or growth focused businesses, these advantages matter far more than avoiding a hypothetical future liability.

Starting with PG-backed credit also builds the history lenders want to see before offering non-PG options. Every responsible payment reinforces the business’s reliability and deepens the relationship. This pathway helps you graduate to better products over time because the bank can trust both the company and its leadership.

A PG also broadens your funding choices. You gain access to major banks, premium business credit cards, unsecured lines of credit, and relationship-based financing that would not be available through a non-PG route. This creates more flexibility for managing cash flow and planning long term strategy.

The key point is control.

Don’t be afraid to start at the bottom of the ladder.

Final Takeaway: Your Goal Is Access, Not Avoiding Guarantees

The focus of any funding strategy should be greater access to reliable credit, not avoiding personal guarantees by default. Non-PG options have their place, but they often limit growth for businesses that need flexibility, higher limits, or faster approvals. Using a PG early creates momentum because it opens the door to better products and deeper bank relationships.

When the business performs well, the PG becomes a formality rather than a source of risk. You gain leverage through trust, and lenders treat your company accordingly. The owners who understand this sequence reach stronger funding positions sooner, while those who chase non-PG prematurely often slow themselves down.

Book Your Strategy Call

Ready to Secure Better Funding?

Book your strategy call and start your journey.