How to Manage Cash Flow with a Business Line of Credit

Oct 17, 2025

Cash flow problems are one of the top reasons small businesses fail. You can have solid sales, good margins, and loyal customers, but if the timing of money coming in doesn’t line up with money going out, your business feels the squeeze. Payroll, materials, and vendor payments don’t wait for invoices to clear.

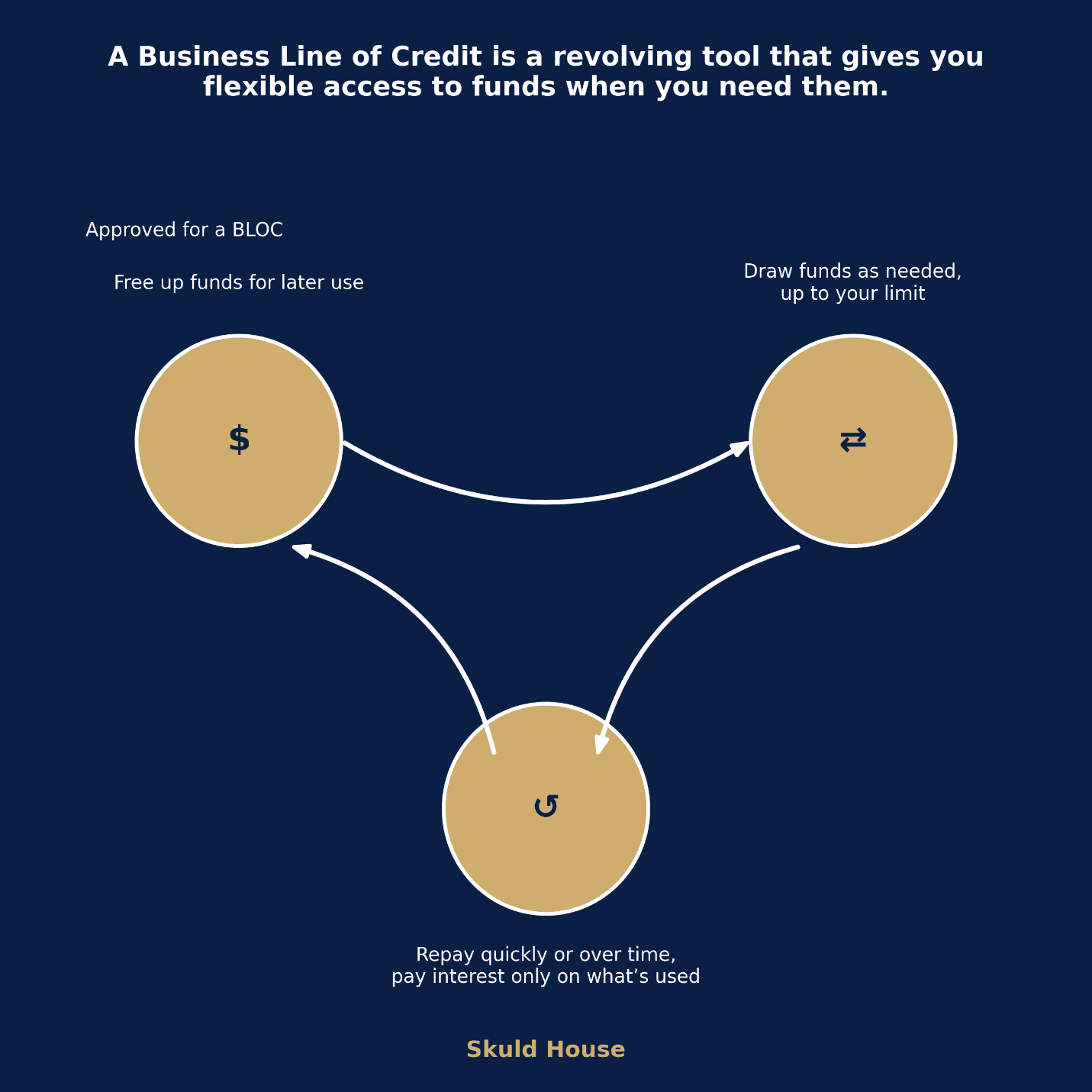

That’s where a Business Line of Credit (BLOC) comes in. A term loan locks you into a single lump sum with fixed payments. A BLOC, by contrast, gives you flexible access to working capital you can draw as needed and repay when cash comes in. Think of it as a safety net that covers short-term gaps so you can keep operations running smoothly.

In this guide, you’ll learn:

How to use a BLOC for payroll, materials, and other cash-like expenses

How interest charges work and when they start

How to build a usage pattern that actually improves your borrowing power

Common mistakes to avoid so your BLOC stays a tool, not a trap

By the end, you’ll know how to use a business line of credit to manage cash flow responsibly and build stronger banking relationships for future growth.

What Is a Business Line of Credit and How Does It Help Cash Flow?

A Business Line of Credit (BLOC) is a revolving form of financing. Instead of one-time debt, it works more like a reusable account: you draw, repay, and then draw again. Interest only applies to the amount you use, and once you pay it back, your credit limit resets; this makes it well suited for managing ongoing cash flow.

For small businesses, the biggest advantage is smoothing cash flow. Sales and invoices don’t always line up with when bills come due. A BLOC acts as a bridge so you can cover expenses today and repay when revenue arrives.

Here are a few common situations where a BLOC keeps operations steady:

Payroll: Making sure your team gets paid on time, even if customer payments are delayed.

Materials and supplies: Covering upfront costs for projects before clients reimburse you.

Unexpected expenses: Handling equipment breakdowns, repairs, or sudden opportunities without draining your reserves.

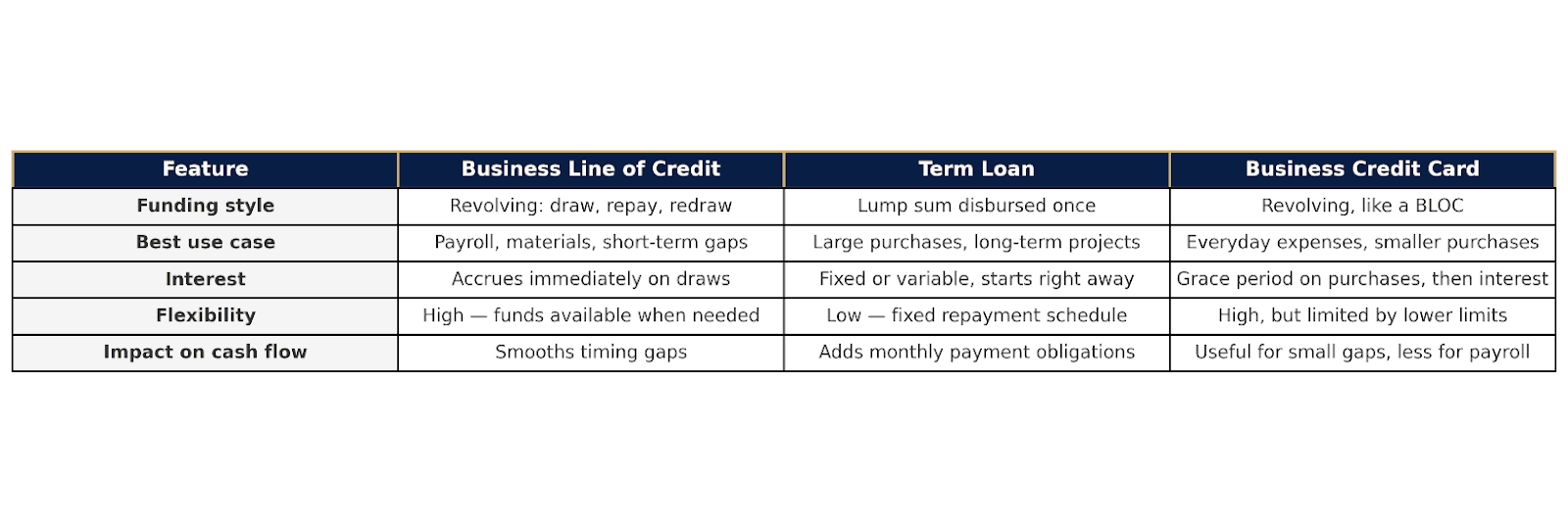

How a BLOC Compares to Other Financing Options

Put simply, a BLOC is a short-term safety net. It allows you to keep your business moving forward instead of stalling while you wait for receivables to clear.

How Does Interest Work on a Business Line of Credit?

One of the most important things to understand about a Business Line of Credit is how interest is charged. Unlike a credit card, which often gives you a grace period before interest starts, a BLOC accrues interest as soon as you draw funds. That means the daily balance matters, not just the statement balance.

Key Points to Know

Interest starts immediately: If you pull $10,000 today, interest begins today.

Calculated daily: Banks typically calculate interest using the average daily balance method. Each day’s balance is tracked, then averaged over the cycle.

Pay only on what you use: If your approved limit is $50,000 but you only use $5,000, you only pay interest on that $5,000.

Billed monthly: Interest is usually billed at the end of the statement cycle. It doesn’t “compound” daily unless you let billed interest roll over.

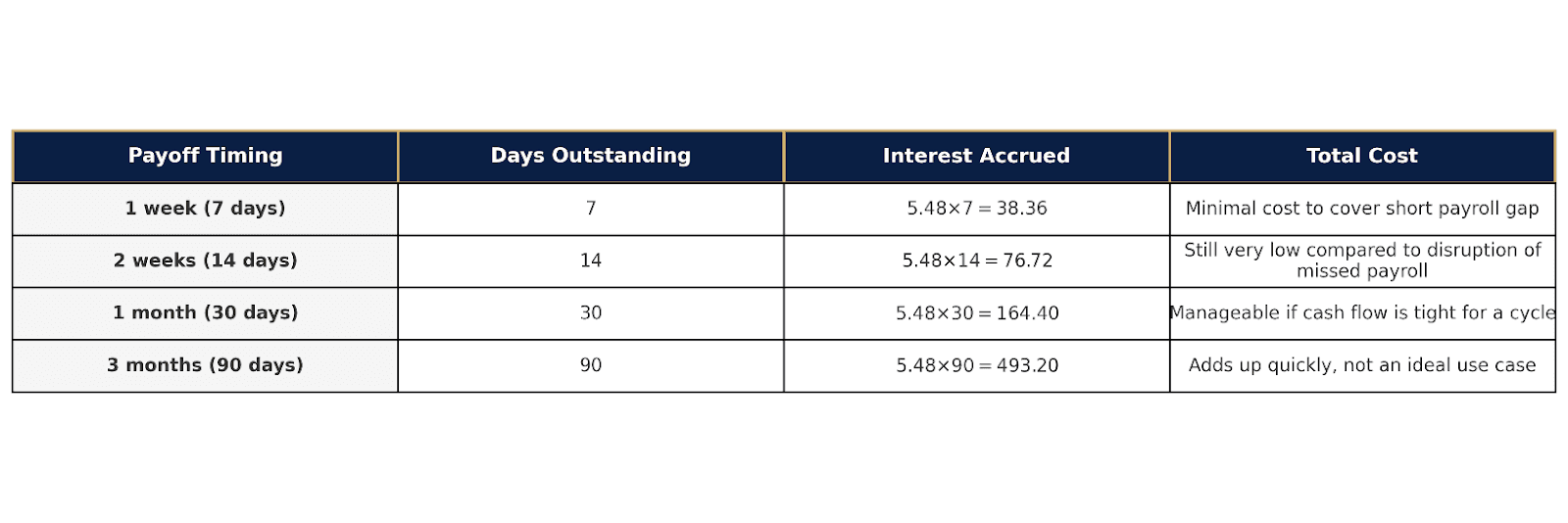

Example: Payroll Draw of $20,000 at 10% APR

Let’s assume:

You draw $20,000 on Day 1

You make no payments until payoff

Interest accrues daily, no compounding

Daily interest = $20,000 × (10% ÷ 365) ≈ $5.48

Note: This example assumes no payments until payoff. In reality, partial payments during the month reduce the daily balance and lower the total cost.

What’s the Best Way to Use a Business Line of Credit to Build Credit History?

A Business Line of Credit isn’t just about accessing cash. How you use it determines whether banks see you as a responsible borrower worth higher limits and better terms. Lenders want to see that you understand the tool and can manage it without overextending.

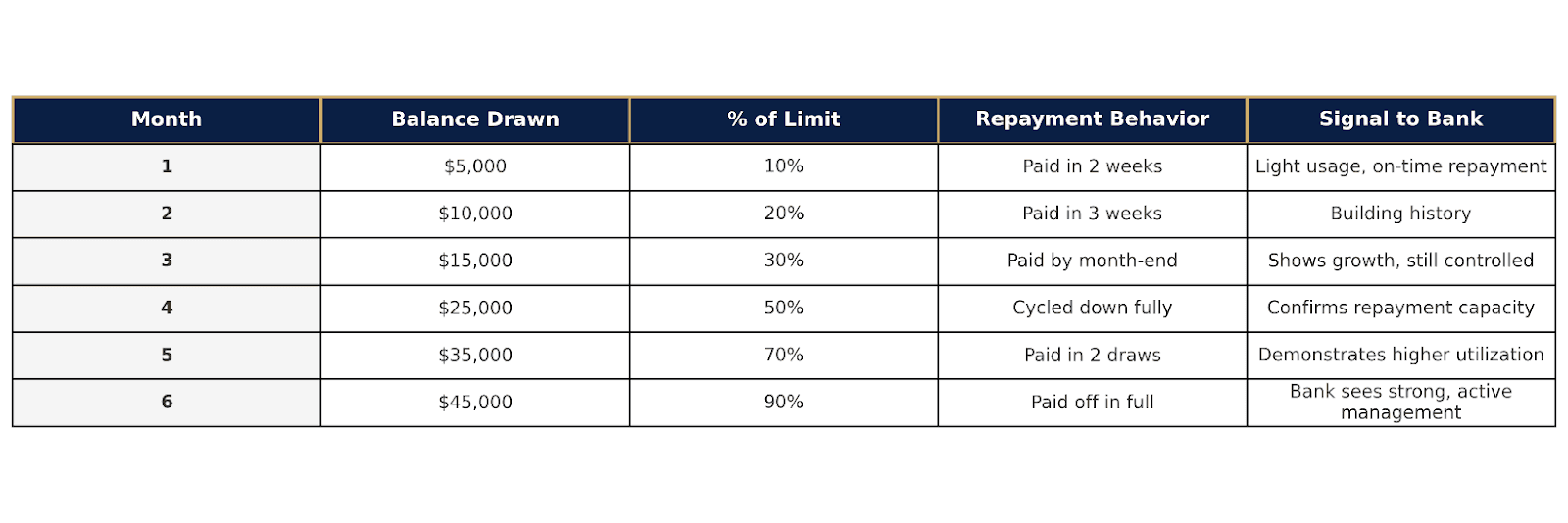

Early Usage Strategy (First 3–6 Months)

When you’re new to a BLOC, think of it as proving ground. Banks want to see activity, repayment discipline, and smart utilization.

Draw small amounts first: Pull a manageable amount (5–20% of your limit) and leave it outstanding for a week or two.

Cycle balances monthly: Pay it back down to zero once per month if cash flow allows. This shows you can both use and repay.

Increase utilization slowly: After a few months of clean history, you can begin using larger percentages of your limit.

Example: Responsible Growth Pattern

Assume you’re approved for a $50,000 BLOC. Here’s how usage might look:

*Exact calculations vary by bank. Always confirm your lender’s method.

This pattern proves you can handle increasing responsibility. After six months of disciplined usage, you’re in a strong position to ask for a higher limit or negotiate better terms.

Note: The chart above is simply an example. To see options to build a custom plan FOR YOU, book a Discovery Call.

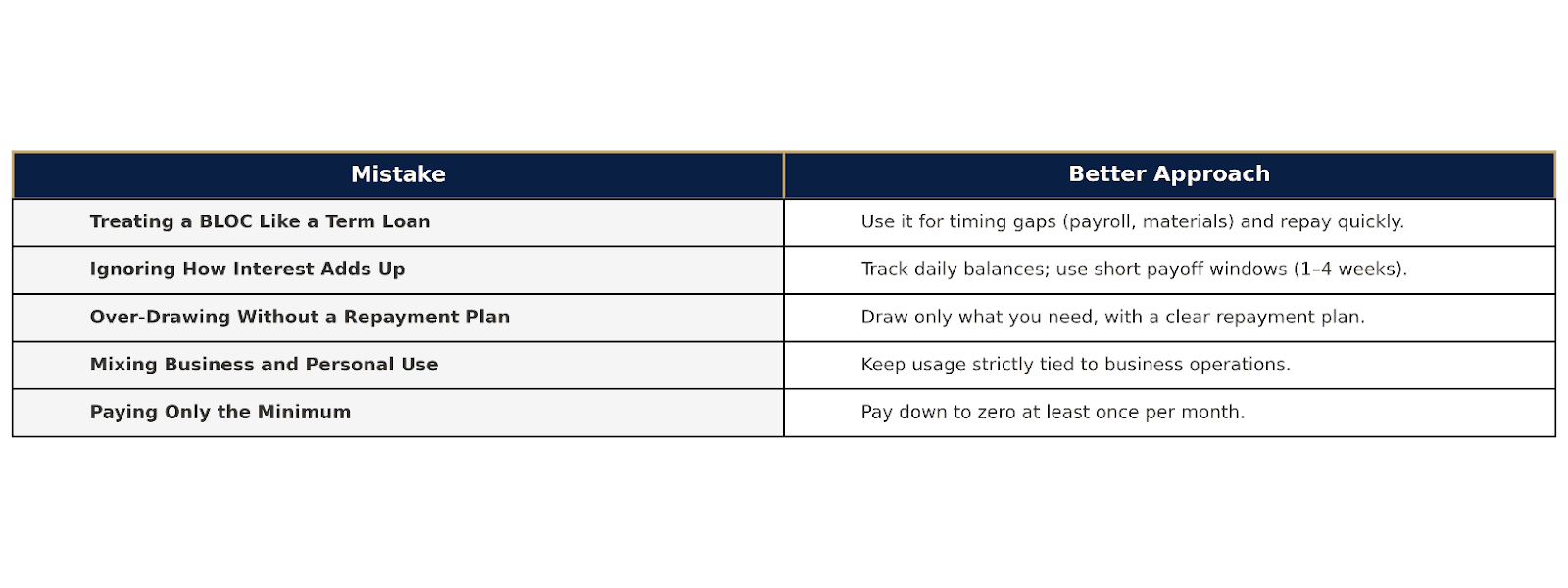

What Mistakes Should You Avoid with a Business Line of Credit?

A Business Line of Credit is one of the most useful tools for managing cash flow, but misuse can turn it into a liability. Here are the most common mistakes business owners make and how to avoid them.

1. Treating a BLOC Like a Term Loan

A BLOC is not designed for long-term financing. Leaving large balances outstanding for months turns a flexible tool into expensive debt.

Better approach: Use it for timing gaps (payroll, materials) and repay quickly once cash comes in.

2. Ignoring How Interest Adds Up

Because interest starts immediately, balances that sit for 60–90 days can cost hundreds or thousands in interest. Many owners underestimate how fast it accumulates.

Better approach: Track daily balances and use short payoff windows (1–4 weeks) whenever possible.

3. Over-Drawing Without a Repayment Plan

Pulling funds “just in case” creates unnecessary interest costs and can spook underwriters if they see no clear repayment rhythm.

Better approach: Draw only what you need, with a clear plan for how incoming cash will cover it.

4. Mixing Business and Personal Use

Using a BLOC for personal expenses muddies your financial picture and can damage your relationship with the bank.

Better approach: Keep it strictly tied to business operations, even if you’re a sole proprietor.

5. Paying Only the Minimum

Most banks require an interest-only minimum payment. Relying on this keeps your balance high and signals weak repayment behavior.

Better approach: Pay down to zero at least once per month if cash flow allows.

Avoiding these mistakes not only saves money but also strengthens your standing with lenders, setting you up for higher limits and better terms in the future.

TL:DR

Putting It All Together

A Business Line of Credit can be the difference between struggling through cash flow gaps and keeping your business moving forward with confidence. Used correctly, it covers payroll, materials, and unexpected costs without draining your reserves. More importantly, the way you manage it (cycling balances, paying down quickly, and showing disciplined usage) builds trust and positions you for higher limits and better terms over time.

The challenge is that most business owners are never shown how to use a BLOC strategically. They either avoid using it out of fear, or lean on it too heavily and pay the price in interest. You want better. You want to show patterns that prove you know how to manage credit like an asset.

At Skuld House, that’s exactly what we help business owners do: turn a strong credit profile into real-world funding strategies. If you want to see how a tailored borrowing plan can fit your cash flow, book a low pressure Discovery Call.

Book Your Strategy Call

Ready to Secure Better Funding?

Book your strategy call and start your journey.